Time flies as we again report on our DIY Portfolio progress. In a

similar fashion, you can expect our next update in about 12 weeks.

You can have a look at previous portfolio updates here:

Lots of companies have to reform their entire business model in these changing times. Some still thrive and even found unforeseen ways to reduce their costs. Others, not so much. Maintaining some level of sales or surviving till things get back to the new normal may be the key for most.

Despite all uncertainties, a lot of positives may be coming out of this year’s turmoil. For one thing, we were kind of obliged to adopt environment friendly solutions like telecommuting. A sense of solidarity also greatly developed in several communities. Even more important for humanity’s sake, you know who will probably get kicked out.

The next big question for many worried investors is how will the markets react to all of this?

Once more, I’ll remind you that I am not an investment or tax professional of any kind. The intent of this blog is not to give specific investing advice. Before investing yourself, we suggest you do all necessary research and consult a licensed financial professional if need be.

Still Going Strong

Our answer is still somewhat the same: we don’t really know but don’t care that much.

What is important is that we remain confident our DIY Portfolio will fare well in the long haul, no matter all these short-term interrogations.

After all, rising markets provide us interesting returns. On the other hand, declining markets still provide appealing buying opportunities. We just have to remain ready to seize them at any given moment.

Our DIY Portfolio value is back in the positive for the year. Which is a tad surprising will all ongoing crisis affecting markets on several fronts. But as we said before, the worst of it may still be coming. And again, there’s no point constantly worrying about it. It’s the reality of the markets, they always fluctuate, and we never know which direction they will take next.

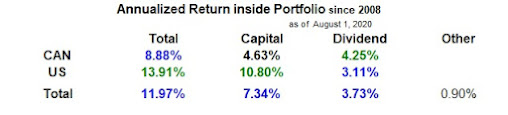

For now, our overall long-term portfolio performance still hovers around 12%. With somewhat anticipated levels of dividends around 4% and capital gains near 8%.

Last time, we talked about a wild ride and looks like we survived it thus far.

Canadian Content Significantly Lagging US

What has been very

different lately is that Canadian stock price levels have been severely

battered down in the last few months. And contrary to their US counterparts,

they have not rebounded up as much.

What has been very

different lately is that Canadian stock price levels have been severely

battered down in the last few months. And contrary to their US counterparts,

they have not rebounded up as much.

In our case, this translates in the US side of our DIY Portfolio doing very well with a total return near 14%. Our Canadian side of things is much lower with a total return around only 9%. The main difference comes from a US capital return of almost 11% versus a pretty anemic Canadian capital return under 5%.

Should we be worried about our Canadian stocks doing so bad?

Again, we are not that worried. We simply view these figures as a hint of what may be coming for Canadian stocks: much better days.

In our last report, we stated the Canadian portion of our portfolio needed some love. So, in practice, this will simply mean we will proportionally buy more Canadian stocks for a while. You have to see it as good Canadian stocks being on sale. And when something good is on sale, you can afford to buy more.

Not that it matters than much, but our timing may be great because most of our new money will be invested in our TFSAs and TFSAs are a very good place for Canadian content. All of our US content remains in RRSPs to avoid the 15% US withholding tax on dividends.

Speaking of the US, our figures with returns quite high also imply US stocks may be expensive right now. We will consider it as a warning and a sigh that a decline of US stock prices could be approaching. We won’t really sell any of our US stocks but will buy less for now. We will prepare ourselves to aggressively buy again only after the expected decline.

Again, it’s not that important if it’s imminent or not. We are not trying to predict any of it as, for a while, our strategy has been to only react after the facts, only considering buying after declines or more rarely, selling after upsurges. We just have to remain patient and try to prepare for it.

New Faces and Exits

Speaking of patience, we lately lost ours with one of our long time holding, Scotia Bank (BNS). We replaced BNS with National Bank (NA) and still hold 3 other solid Canadian banks in TD bank (TD), Royal Bank (RY) and Bank of Montreal (BMO). We’ve always liked steady stocks but BNS has been stalling for a while. Contrary to anticipations, BNS does not seem to be able to reproduce its successful domestic business model internationally. While still being quite safe, NA should provide a little more zip than BNS.

South of the border, the crisis made coffee giant Starbucks (SBUX) look appealing. We grabbed a few shares despite their business model not being perfect in the circumstances. We can still see encouraging signs that they are adapting well.

We had more time for some research and another newcomer showed up on our radar, Blackrock (BLK). BLK is the global management investment corporation responsible for famous iShares products. BLK is the largest provider of Exchange-Traded-Funds (ETFs) in the world. For the last few decades, BLK stock has shown a solid track record providing constantly growing dividends.

Reluctantly, we decided to cash in on our profits on Disney (DIS). We sold all our shares after the entertainment giant announced a dividend cut. Despite amazing timing on their new streaming service Disney+ helping a lot, we just don’t see Disney doing well in the next few years. We still really like everything about Disney and probably will get back to them after the new normal permits travelers to get back to their traditional Magic. Meanwhile, we decided to use 3M (MMM) and Automatic Data Processing (ADP) as relief pitchers.

On the Canadian side of the force, we decided to make a riskier play on battered down CAE (CAE). As a prolific international flight simulator specialist, CAE is also greatly affected by airplane travel suddenly nearly non-existent. CAE also halted its dividend payments but quickly adapted its manufacturing facilities to build ventilators desperately needed in our fight against COVID-19.

Over the last few months, we bought quite a few shares of telecom giant Telus (T). Like Canadian banks stocks, telecoms had a tough time because of the crisis but we are confident they will get back on their feet and provide more than interesting performance in the long haul.

Despite being a little slower, telecom competitor Bell Canada (BCE) is also on our shopping list. BCE can provide a solid base for any portfolio and will help us diversify our telecom holdings.

Even though they look a

tad pricey, Canadian National Railway (CNR)

and Metro (MRU) are quite high on our buying list as we are looking to

add up to our existing positions. Chances look even brighter for Fortis (FTS)

and Emera (EMA) as relatively, they seem a little more affordable.

No comments:

Post a Comment